USBAM Chart of the Month - Core Personal Consumption Expenditures

January 28, 2021

This month, Senior Portfolio Manager Mike Welle takes a closer look at Core Personal Consumption Expenditures - Median Private Forecasts.

Mike Welle, Senior Portfolio Manager

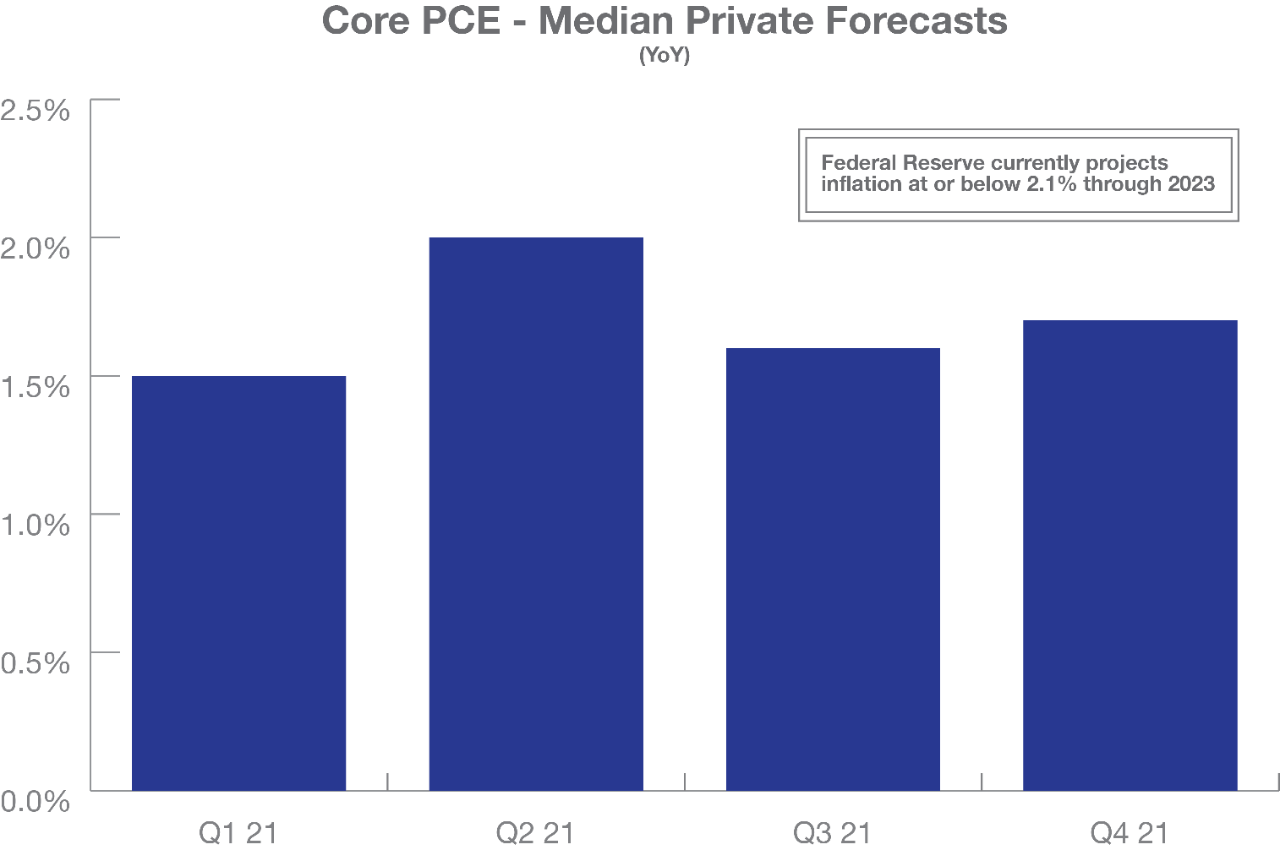

Massive amounts of fiscal stimulus have stoked investor concern over looming inflationary pressure. Media airwaves have carried dire warnings recently of a sharp rise ahead for inflation gauges. We look to one of our newest charts "Core Personal Consumption Expenditures (PCE) - Median Private Forecasts" for further perspective.

Bloomberg collects economic forecasts from several market participants including banks, broker-dealers, rating agencies, academic institutions and others. The data is refreshed daily as new updates are received from these contributors. Currently, approximately 50 responses are represented in the inflation data set.

Federal Reserve (Fed) Chair Powell has made it clear the Fed is looking for persistent inflation above 2% to even begin considering raising short term interest rates. Fed Vice Chair Richard Clarida recently made similar comments suggesting a time period of around a year might satisfy the "persistent" definition. The quarterly forecasts are invaluable then, in showing investors a potential path for both inflation and short-term rates.

The chart forecasts a spike higher in PCE during Q2 2021, before receding in subsequent quarters. The consensus view among economists is that elevated numbers in the coming months will likely be temporary - and based primarily on weak price levels seen during the spring of 2020. We agree with this view and believe it is unlikely this stronger-looking data will get the Fed's attention in a meaningful way. We do acknowledge there is some possibility the forecasters may be under-appreciating the potential for inflation to run somewhat higher. It seems reasonable to expect that as prices for things like airfares and hotels normalize it should provide some lift to inflation. We have seen some estimates that these travel-related areas along with apparel may be depressing PCE by up to 50 basis points. It is noteworthy though, the Fed's own estimates for inflation remain well contained through 2023.

Inflation trends should be monitored closely in the months and quarters ahead. Private sector forecasts are one tool that can be used in this analysis.

Sources

Bloomberg

Federal Reserve

Reuters